IFTA fuel tax reporting

Simplify International Fuel Tax Agreement (IFTA) reporting and eliminate the administrative burden of collecting state mileage and fuel receipts.

Automate complex calculations

Let Motive do the math for you — from distance traveled by jurisdiction to fuel purchases for all fleet vehicles and more.

Improve operational efficiency

Upload receipts from the Fleet Dashboard or the Motive Driver App. Transactions made with the Motive Card show up automatically.

Reduce audit risk and human error

Export ready-to-file IFTA reports — free from clerical errors and inconsistencies — with a single click.

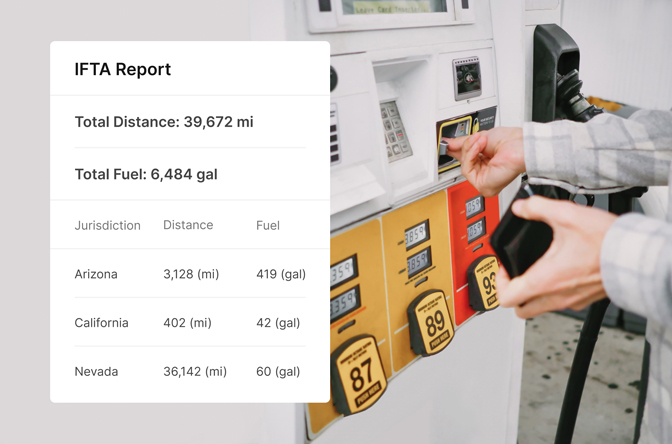

Create IFTA reports.

Automatically calculate the distance traveled and fuel purchased by jurisdiction with Motive’s IFTA reporting software. View trip reports in detail, or filter summaries by date or vehicle type.

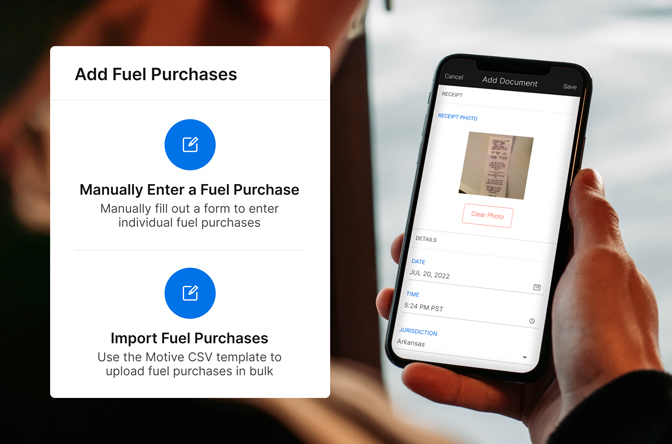

Import fuel receipts.

Add fuel purchases individually, or in bulk, by uploading a CSV file from your fuel vendor. Drivers can also upload fuel receipts on the go from the Motive Driver App.

View Motive Card transactions.

Automatically include Motive Card fuel purchases in IFTA reports. All the driver has to do is pay for fuel using the Motive Card.

Frequently asked questions

What is IFTA?

IFTA is the cooperative agreement between 48 states in the U.S. and 10 provinces in Canada. It allows inter-jurisdictional carriers to report and pay taxes for the fuel their vehicles consume across states. Using a single fuel tax license.

Learn more about what IFTA is.

What does IFTA stand for?

IFTA is an acronym for International Fuel Tax Agreement. Adopted in 1996, the agreement allows for the collection and redistribution of fuel taxes paid by interstate commercial carriers through a reporting process.

Learn more about how the IFTA fuel tax works.

How does the Motive Vehicle Gateway help with IFTA reporting?

The Motive Vehicle Gateway uses its GPS sensor and the vehicle’s odometer to track the exact distance a vehicle travels in each IFTA jurisdiction every day. Fleet managers can generate reports in the Motive Fleet Management Dashboard to calculate the total distance each fleet vehicle traveled, and in which state/province for any date range.

Learn how to view and export IFTA reports in our Help Center.

Does Motive account for special mileage exemptions, such as toll roads?

The Motive Vehicle Gateway records a vehicle’s location each minute a vehicle is in motion. A report detailing a vehicle’s location history, combined with distance by jurisdiction, is available in the Motive Fleet Management Dashboard. This report can be used to identify and claim mileage exemptions.

Does Motive automate the filing of IFTA reporting paperwork?

Motive doesn’t yet automate IFTA fuel tax filing. Currently, Motive helps fleet managers with the most difficult part of the process — tracking the distance fleet vehicles travel in each jurisdiction. When drivers use the Motive Card, fuel purchases are automatically added, further simplifying IFTA reporting.

Do I need an IFTA license and IFTA stickers?

You will need an IFTA license and stickers if you operate a motor vehicle that’s built and used to transport property or people.

An IFTA-qualified vehicle also has two axles and a gross vehicle weight of over 26,000 pounds or 11,797 kilograms; or consists of any weight with three or more axles; or is used in combination and has a weight that exceeds 26,000 pounds or 11,797 kilograms.

Learn how to obtain an IFTA license and IFTA stickers.

Contact us

Ready to see how Motive simplifies IFTA reporting?

The Motive Card is issued by Sutton Bank, Member FDIC pursuant to a license from Mastercard International. Subject to the Terms of Service. Mastercard and the circle design are registered trademarks of Mastercard International Incorporated.