If you want to be an owner-operator, now is as good a time to start as any. With the ongoing driver shortage, increasing freight demand, and rising rates, this could be a great time to start a trucking business. But how much does it cost to start a trucking company?

Here is a breakdown of the trucking company startup costs you may have to bear when starting a new trucking business.

How much does it cost to start a trucking company?

An initial cost you can consider when starting your trucking company is about $6,000 to $15,000 (not including your equipment).

This includes registration and formation documentation that, on average, cost from $900 to $1,500. IRP (International Registration Plan) plates could cost you anywhere between $500 to $3,000 per truck. Heavy Vehicle Use Tax and a permit may cost, on average, $100 to $600 per truck. You may also require additional state-specific tax, which would be, on average, $500 per truck.

Drivers may earn $0.40 cents per trucking mile or, on average, about $60,000 a year. According to the U.S. Bureau of Labor Statistics, the median annual wages for all occupations as of May 2020 is $47,130. of A clear profit exists for vehicle moving companies as about 4.8 cents is gained per operating dollar spent. However, some drivers may earn more than that.

This situation would favor smaller operations that can start faster with low investment capital needed. If you ask yourself: “How much do I need to start a trucking company on a large scale?” A typical large-scale trucking business, on the other hand, could need $5 million in capital or more.

“Less is more” is a valid point to consider as you start your own trucking business. You can begin with a single unit, so your startup capital is trimmed to an easily manageable level.

Fixed and variable costs

The cost to start a trucking company may generally be divided between fixed costs and variable costs.

Some of your fixed costs would include the price of your truck unit, regular maintenance, yearly permits, taxes, and insurance costs. On the other hand, some of the variable expenditures would include fuel costs, various repair costs, and fines. In aggregate figures, about 60-70% of your operating costs come from these variables.

Acquiring the US DOT number

Before you start, you would require a US DOT (Department of Transportation) number. You can get an MC (motor carrier) / US DOT number for $300.

Business registration

As a new business owner, you would also have to register your business. The cost of business registration may vary from state to state. Here’s a detailed breakdown of the cost of business registration in each state.

On average, you may require up to $500 to cover the cost of business registration.

Unified Carrier Registration (UCR)

The UCR fee for up to two vehicles is $69. For three to five vehicles, it’s $206.

For more details and information about the registration fee, visit the UCR website.

How much is a truck? New vs. used

The equipment you acquire should be in excellent condition.

Paying a premium on these makes more sense down the line because your maintenance costs would be lower. However, you may also acquire a used unit for as long as its maintenance record is spotless and its files are accurate.

A solid and roadworthy second-hand unit also has the advantage of having lower yearly insurance premiums, which is a route that makes sense for new businesses.

Choose a rig that is five years old or younger, with a Detroit Diesel engine that has less than 600,000 miles in it. You may pay more dollars for the specs above, but this will translate to an average of eight to 10 years of worry-free operations without expensive repairs.

A common mistake that new truckers make is to save on equipment costs, only to regret this decision when the truck breaks down (countless times) and requires frequent repairs out of the base.

So how much does a truck cost? Buying a truck can cost you anywhere between $15,000 to $175,000. Expect a down payment somewhere between $1,000 to $10,000—depending on the vehicle you choose.

Getting insurance

Insurance coverage is one of the most important annual fixed costs. Several factors are considered to determine your total insurance costs.

Among the primary aspects considered are the age of your equipment, commodities hauled, and the location of your truck. These factors are accounted for by the insurers when putting together your insurance premium.

Depending on the condition of your truck, the annual insurance cost could be up to $10,000 per truck. This figure can change based on the type of coverage, the model, year, and condition of the vehicle, and the experience of the driver.

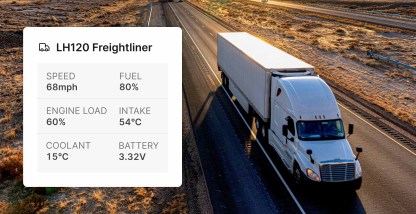

Installing an FMCSA-registered electronic logging device may also reduce insurance premiums.

CDL (Commercial Driver’s License) endorsements

There are several endorsements that you (or your truck drivers) may need to have added to the CDL to be able to operate hazardous cargoes or specialized vehicles. Here are some of the endorsements you can obtain:

H — HAZMAT. You need this endorsement to be able to transport hazardous materials, and is required to be placarded under subpart F of 49 CFR part 172.

Based on government regulations, a “hazardous” material may include gases, explosives, combustible liquids, flammable liquids, and other materials that can cause harm.

Acquiring this endorsement costs about $100 plus an additional $87 for the TSA screening.

P — Passenger transport vehicle operator. This endorsement will enable you to drive over 16 passengers (including the driver). The average fee for this endorsement is $14.

Drivers are also required to take a 20-question test, plus a skill test.

X — Transporting HAZMAT in a tanker. Having this endorsement will allow you to operate vehicles carrying waste or hazardous materials in placarded amounts, which also requires both the H & N endorsements.

The average cost for this endorsement is $14. The driver also needs to take a 30-question tanker test and a hazmat test (20 questions).

Conclusion

Apart from the expenses mentioned above, you should also set aside approximately $5,000 for marketing and acquiring customers. This may include building a website, setting up a social media presence, adverts, business cards, etc.

You should also consider buying a compliant and ELD solution that may minimize some of the variable costs, e.g., reducing fuel wastage by minimizing idling, improving driver safety and reducing potential liabilities by monitoring driver behavior, and reducing administrative burden by automating processes (such as IFTA reporting and vehicle maintenance), etc.

Further reading: The Complete Guide to Canada Hours of Service Rules

If you want to learn more about how to start a trucking business, download our free 8,000-word guide.