The process of filing IFTA fuel tax reports can be overwhelming and time-consuming. It becomes even more problematic and complex if simple mistakes are made.

For many fleets, IFTA fuel tax reporting can be an administrative burden, and they want to complete the reports correctly and efficiently. To help such fleets, we have put together a list of 5 common IFTA fuel tax reporting mistakes that must be avoided.

You will learn how to file quarterly IFTA taxes to avoid IFTA audit fines, as well as what happens if you fail an IFTA audit.

Mistake #1: filing IFTA fuel tax reports late

IFTA fuel tax reports are required to be filed four times a year. The deadlines, however, always seem to sneak up. It’s easy to get distracted or busy and forget about the upcoming deadline. That’s a mistake you must avoid.

Submitting your IFTA report late will lead you to a $50 IFTA late-filing penalty or 10% of the net tax liability, whichever is higher. It may also increase the chances of an IFTA audit.

Furthermore, if an auditor determines that you did not file the returns with an intent to commit fraud, you may receive an IFTA audit fine up to $5,000 and be subject to criminal prosecution.

Mistake #2: making estimates

Since the process of IFTA fuel tax calculation can be very time-consuming and complex, it is tempting to just estimate the miles traveled and the fleet’s average MPG at the end of each quarter. However, it is important not to fall into that trap. IFTA record keeping requirements state that you must record all numbers accurately.

Incorrect fuel calculations may raise doubts and lead to an IFTA audit. You are required to maintain precise records — not estimates — of fuel use and mileage.

Mistake #3: not recording personal miles

One common mistake that some fleet managers make is that they don’t log personal miles. If you don’t include personal miles — for example, miles recorded during a driver’s personal errand — you will have mileage gaps in your records.

Any discrepancy in records may raise red flags and lead to an audit.

Mistake #4: not filing an IFTA fuel tax report

What if your fleet did not operate during a quarter?

You’d still need to file the quarterly IFTA fuel tax report. If you have an IFTA license, you are supposed to submit the quarterly IFTA reports even if your fleet didn’t operate during a quarter.

Mistake #5: ignoring odometer issues

If there is an issue with the odometer, you are expected to address it. Issues with the odometer or GPS tracking can affect the reported numbers and skew them, which is why you must note any such incident.

Conclusion

There is a higher chance of inconsistencies and errors in calculating fuel tax reports if you are using a manual record keeping system. To minimize risks of IFTA audit penalties, use the Motive ELD Pro.

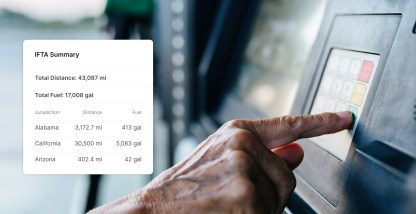

The Motive ELD solution automatically calculates distance traveled and fuel purchased by jurisdiction, improves operational efficiency, and removes clerical errors and inconsistencies.

If you have any questions about the Motive ELD/fleet management solution, call 855-434-3564.