- Understanding IFTA requirements can sharpen awareness of total business activity

- All vehicles used/designed to transport people or property must apply for an IFTA license if they meet certain conditions

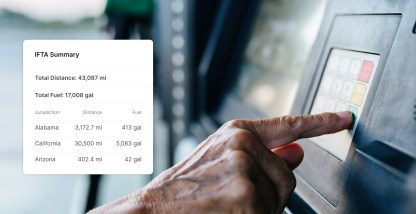

- A fleet management platform can help you create fast, accurate reports

IFTA, or the International Fuel Tax Agreement, was created to streamline the collection and distribution of fuel taxes for carriers who operate in multiple jurisdictions. Traditionally, the transportation industry has been funded by motor fuel taxes. IFTA was a natural byproduct of the growing transportation industry. It exists to ensure public works and infrastructure projects continue to happen today.

Under IFTA, licensed carriers can submit one quarterly tax return to their base jurisdiction concerning fuel usage. This avoids the hassle of individual returns for each state visited. Complying with IFTA regulations is important for the longevity and sustainability of all commercial carriers.

Learn how Motive simplifies IFTA reporting. Request a demo to see it in action.

IFTA fuel tax past and present

As early as just after World War I, jurisdictions levied taxes on the growing number of vehicles on the road. Initiatives like the Multi-State Reciprocal Agreement of 1962 and the International Registration Plan of 1973 helped lay the groundwork for what would become IFTA.

Prior to IFTA’s creation, each truck required a tax permit for each state where it operated. The permit could only be issued at designated Ports of Entry. The permits were issued as stickers that were then arranged on a special license plate called a Bingo Plate.

What we know of as IFTA was born in 1983 when a group of government and industry representatives set out to simplify the payment and documentation of fuel taxes. In 1996, IFTA became law and a mandated regulation for carriers operating in the lower 48 United States. It eventually included 10 Canadian provinces as well.

Is IFTA required?

Yes, federal law requires that commercial truck companies abide by IFTA regulations. Registration is non-negotiable if your truck meets certain criteria.

Compliance is a more streamlined and consolidated process than ever before. Once a carrier has an IFTA license and decals, reporting can begin. Digital tools like GPS fleet tracking systems and trucking management software can help streamline this process even more.

Who has to register for IFTA?

Qualified motor vehicles used/designed to transport people or property may require IFTA registration if they:

- Have three or more axles

- Have two axles and a gross vehicle or registered gross vehicle weight of more than 26,000 pounds or 11,797 kilograms

- Are used in a combination that has a combined or registered gross vehicle weight of more than 26,000 pounds or 11,797 kilograms.

Just to confuse you… There are vehicles that fall under this definition but do not require an IFTA license, like an intrastate vehicle.

To be licensed for tax reporting, these vehicles must use diesel, propane, or natural gas. Some jurisdictions even require gas-powered vehicles to be licensed.

Documents and applications — IFTA requirements

All carriers must keep fuel use records. Either a digital or hard copy will do. An annual license is required for every vehicle that qualifies. Each year, your base jurisdiction may send you a reminder to file your IFTA. But the responsibility falls to each carrier to remember to apply and to store the license properly once they get it.

Vehicles with active licenses are given two decals to display. Each carrier registers a base state that their vehicles operate out of. But the single license and one set of decals allows operation through all member jurisdictions. Only the base jurisdiction performs audits.

The importance of fuel tax reporting — IFTA reporting requirements

What are IFTA fuel tax reporting requirements?

A comprehensive fuel tax report is required four times a year. Quarterly reporting dates are:

Reporting Quarter

- Jan. – March (Q1): April 30

- April – June (Q2): July 31

- July – Sept. (Q3): Oct. 31

- Oct. – Dec. (Q4): Jan. 31

The IFTA agreement says that commercial carriers must keep precise records of fuel purchases, mileage, and fuel taxes accrued in each state or province they traveled in. Payment by check can be made with the quarterly report. And if taxes were over or underpaid, you’ll receive a credit or a bill.

To receive a refund or tax credit, you’ll need to provide receipts for fuel tax purchases along with your quarterly forms. Smooth IFTA reporting requires accuracy and timeliness. There are penalties if IFTA is filed inaccurately or late. Many fleets find that the most efficient way to create accurate, error-free reports is to use a technology solution to track IFTA data points by jurisdiction.

Frequently asked questions about IFTA requirements

Here are a few final questions to keep in mind when developing your strategy for fulfilling IFTA requirements:

Are IFTA regulations in effect for my region?

The IFTA requirement is in effect for all lower 48 U.S. states (which excludes Hawaii, Alaska, and the District of Columbia) and the following 10 Canadian provinces: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland, Nova Scotia, Ontario, Prince Edward Island, Quebec, and Saskatchewan.

What are the IFTA fuel tax exemptions?

There are some exemptions to fuel tax reporting requirements. Driving on certain private roads, on Native American reservations, or on specific toll roads could be exemptions. Use the IFTA Exemptions Table to double-check where exemptions apply.

What if my company gets audited?

Audits are a regular process for all IFTA jurisdictions, which are in fact required to audit 3% of their members within any given year. In general, auditors need immediate preliminary information to grasp the depth of their audit. Having accurate information on hand is key to ensuring an audit goes smoothly to avoid further fees.

IFTA is sort of like a litmus test for each commercial carrier’s knowledge of their own business operations. It can be tedious to collect and store all the information a business generates within a given time period.

Technologies like GPS asset tracking can be invaluable tools to help make sure IFTA reports are correct.

IFTA reporting doesn’t have to be tedious

It’s important for all commercial vehicle and fleet owners to have a firm grasp of IFTA reporting requirements. It is complex. It has obstacles. But IFTA was created to make your life easier and simplify fuel tax collection.

Wondering how you can streamline IFTA reporting for your fleet? The best thing you can do is start familiarizing yourself with the tools that are available to you. A modern fleet management platform can go a long way towards making data collection and fuel tax reporting a simple, low-stress task.

With a cutting-edge technology solution, there is no reason to crunch numbers by hand. You won’t have to fill out the paperwork with a pencil. And you can get rid of those calendar reminders for reporting.

Technology can free up your time and reduce the risk for errors. Making audits less likely and keeping costs low.

Expand your IFTA knowledge with these articles:

Simplify IFTA reporting with Motive.

Eliminate the burden of collecting state mileage and fuel receipts for IFTA reporting. Get a tour to see it work in a real-life scenario.