ELD Compliance

Automate ELD compliance and take a proactive approach to risk management.

Automate ELD compliance and take a proactive approach to risk management.

Built for managers

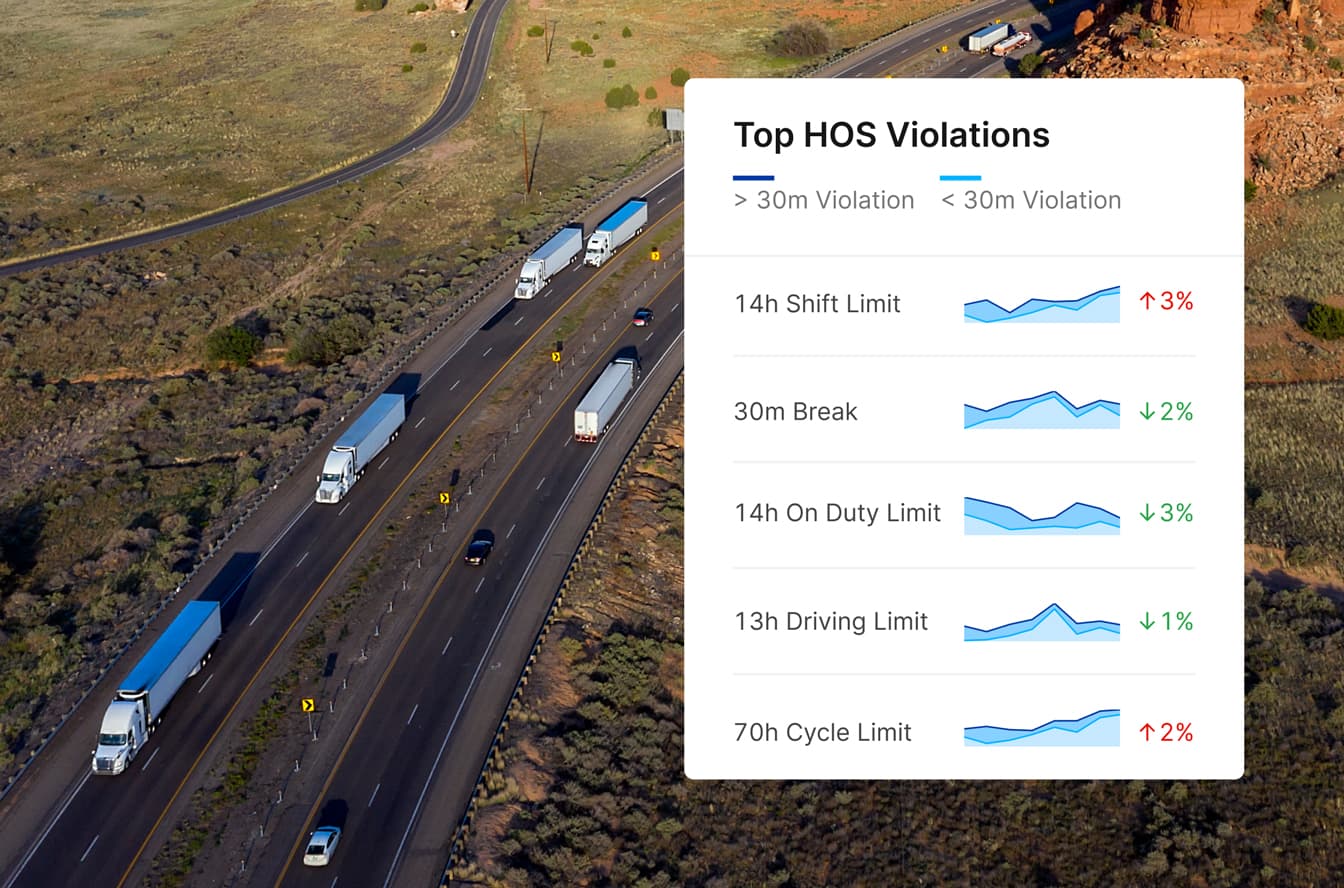

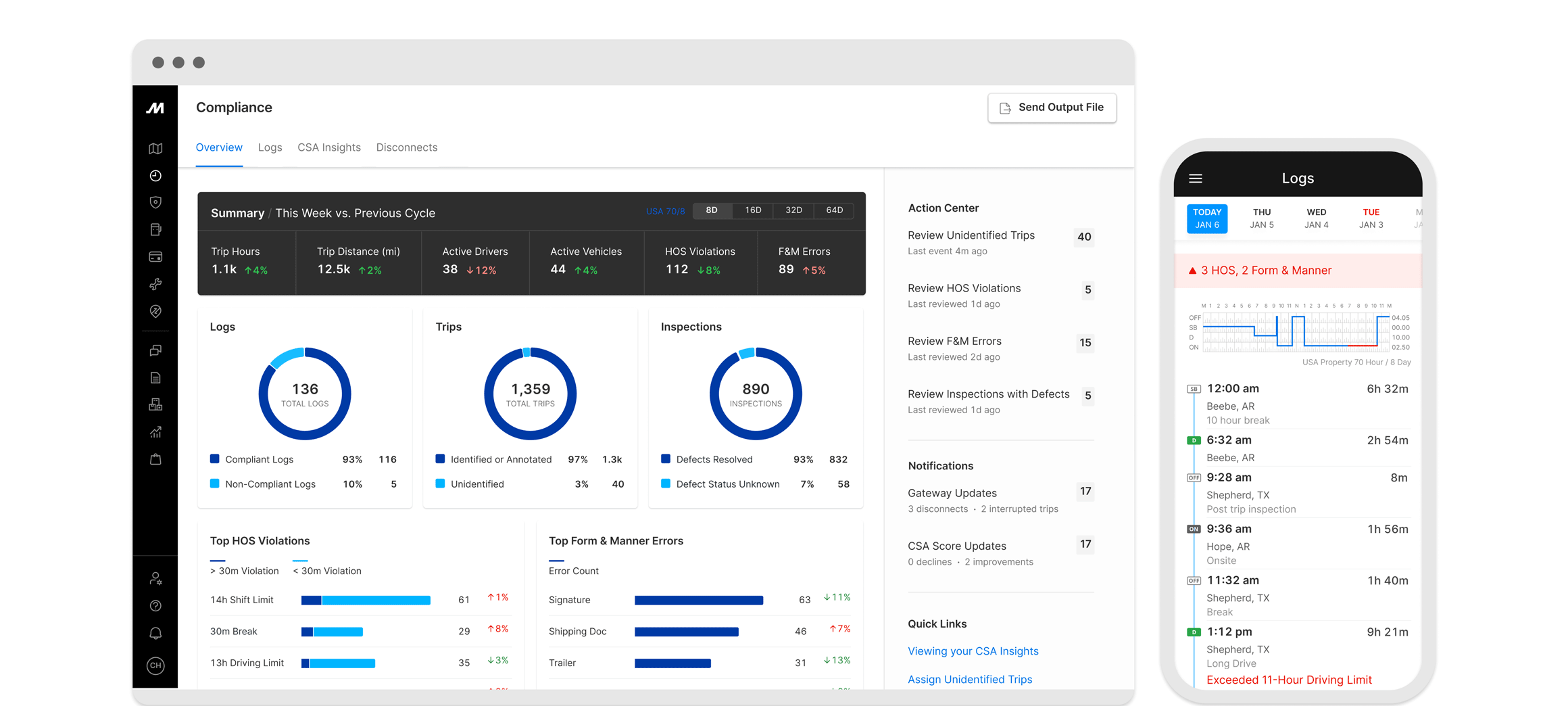

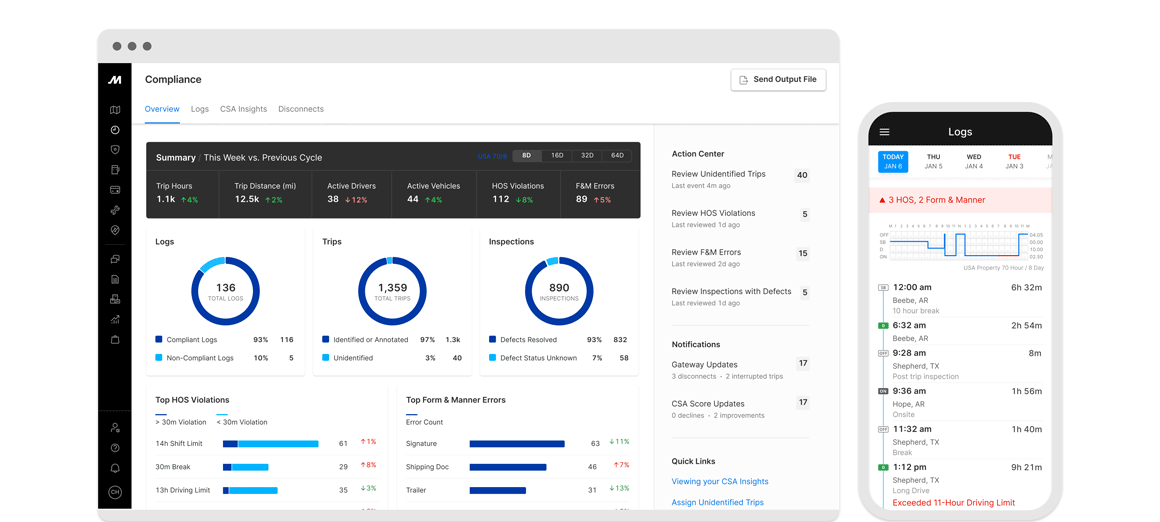

Reduce HOS violations and time spent on ELD compliance tasks by up to 50% by taking a proactive approach to risk management with our compliance management suite.

Designed for drivers

Help drivers complete daily compliance tasks faster and more efficiently with our #1 ELD and top-rated Driver App. Teams with multiple drivers can easily manage HOS from one device.

Certified for U.S. and Canada

Stay compliant with the Motive ELD. Our ELD compliance solution meets the certification requirements of the FMCSA and Transport Canada.

Operate more efficiently with AI.

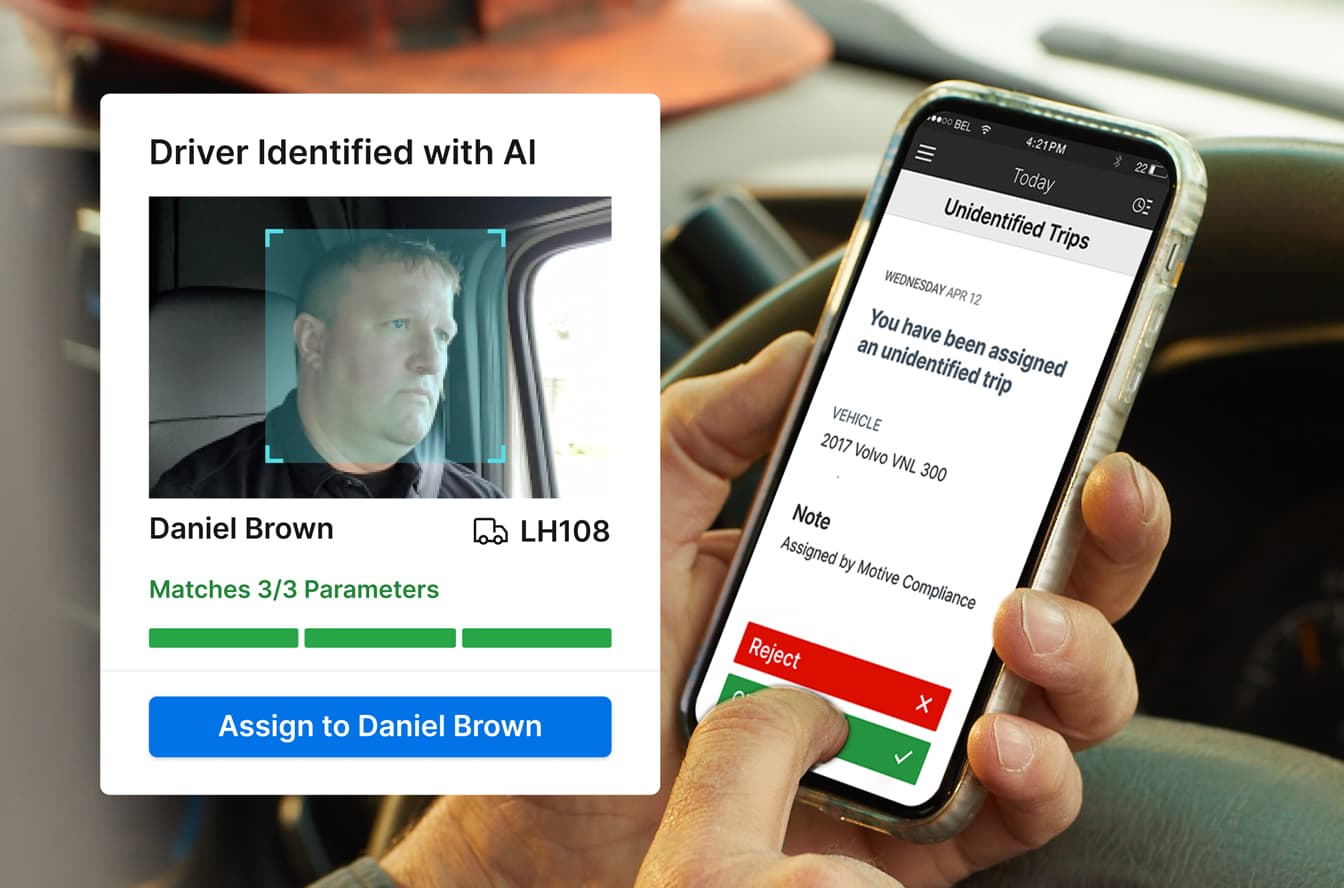

Automatically match drivers with unidentified trips and notify them in real time via the Motive Driver App, using AI trip assignment.

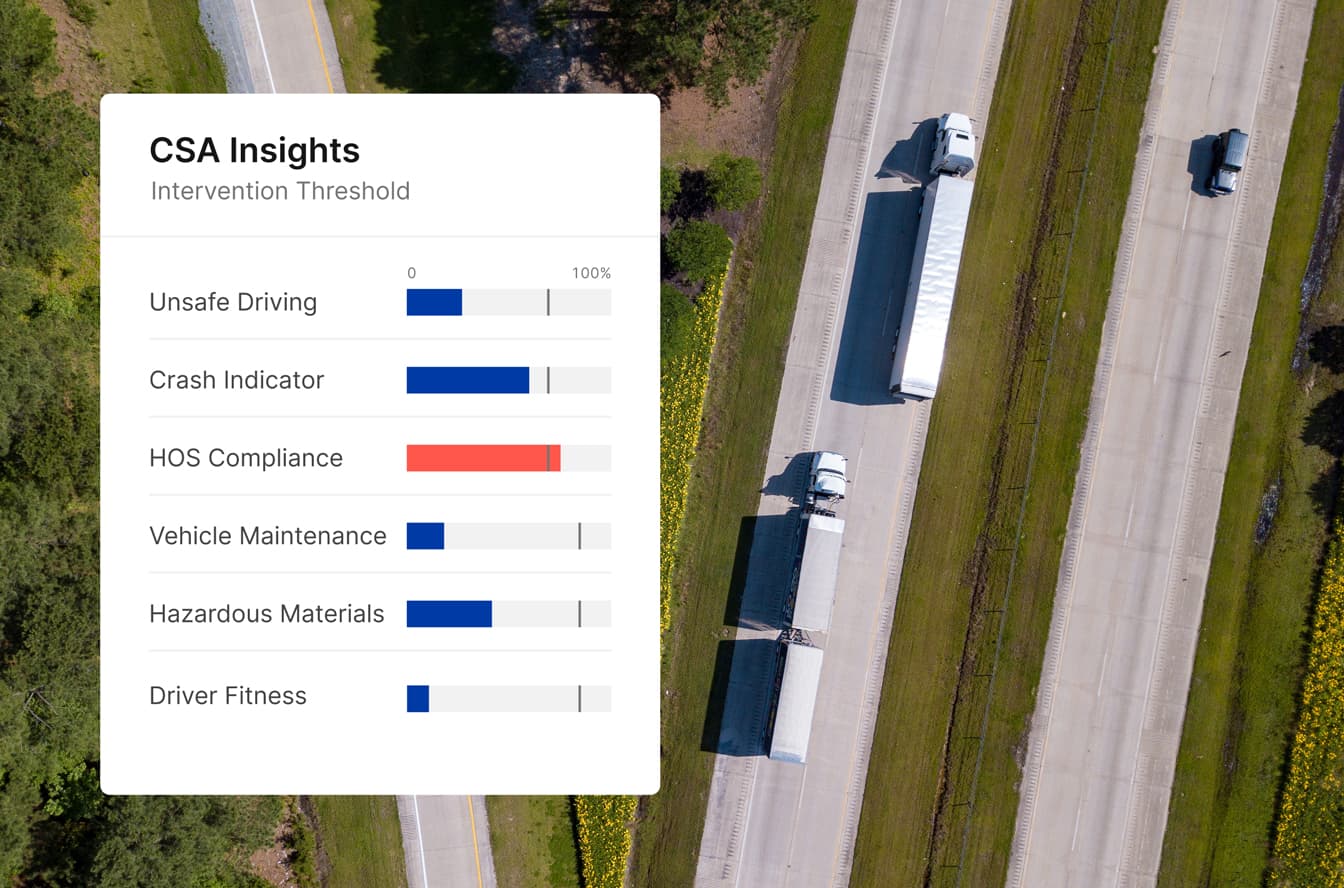

Improve your CSA score and lower insurance costs.

Reduce risk with forecasted CSA scores, intervention thresholds, and violation breakdowns. Identify your fleet’s most pressing issues with proactive CSA score monitoring. Pair CSA data with the Motive Safety Score to get a complete picture of your drivers’ risk profiles.

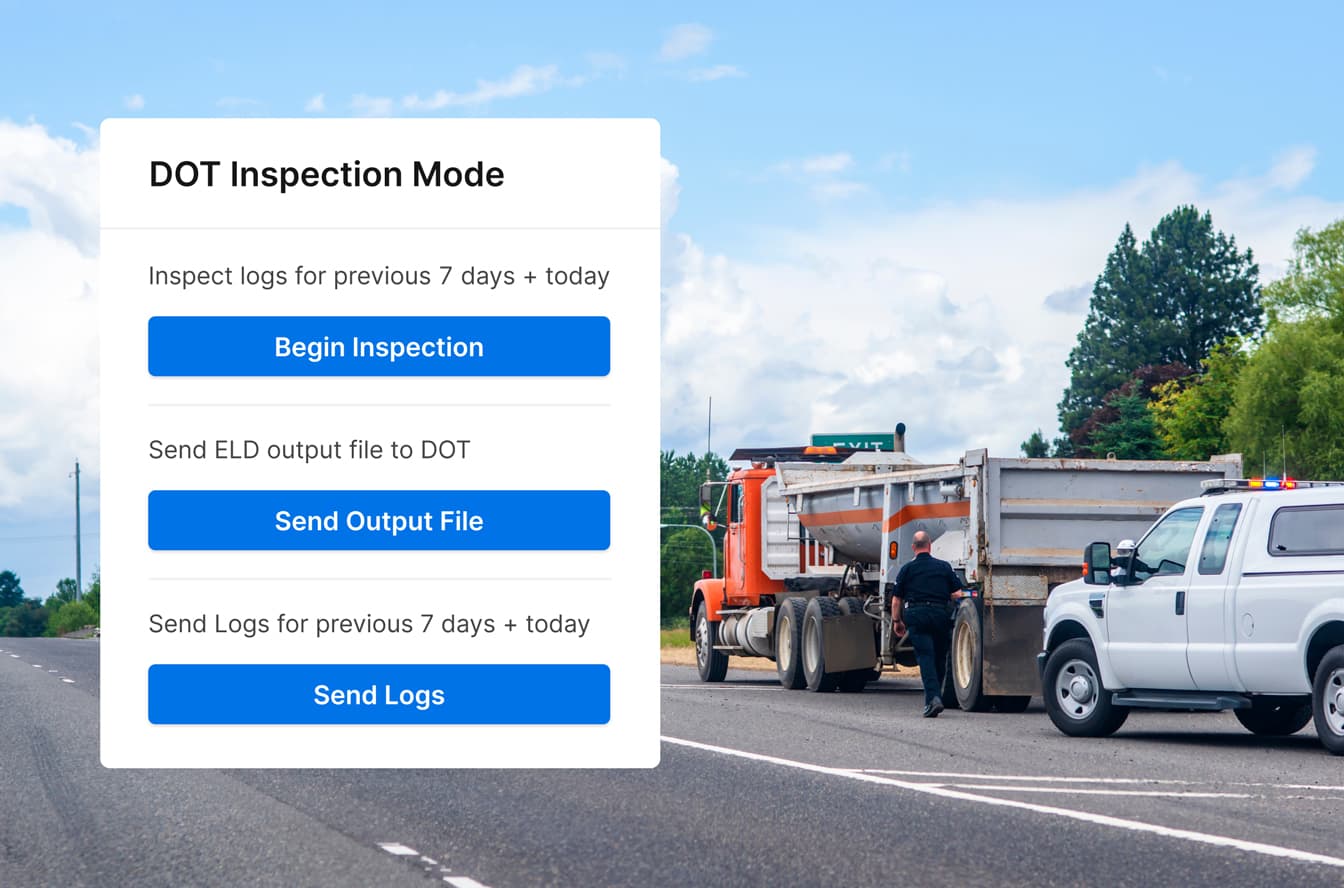

Ace roadside inspections.

Prevent ELD compliance violations with intuitive HOS countdown clocks and proactive alerts in the Driver App. Manage IFTA, DVIR, and HOS in one solution and ace roadside inspections with our easy-to-use ELD.

Frequently asked questions

Is the Motive ELD solution compliant with the U.S. and Canada ELD mandates?

Yes, the Motive ELD is certified for use across the U.S. and Canada. Our ELD is FMCSA-registered and built specifically to meet the regulatory requirements of the U.S. ELD mandate. In Canada, ELDs need to be certified by a third-party certification body. Motive is fully certified on both Android and iOS for the Canadian ELD mandate.

Learn more in our ELD guide and Canadian ELD Mandate guide.

Do I need an ELD if I’m already using the Motive Driver App?

The Motive Driver App, when used alone, provides a fully editable electronic logbook that replaces paper logs. The standalone Motive Driver App is compliant with USDOT / FMCSA rule 395.8 regarding a driver’s record-of-duty status and Canada’s commercial vehicle drivers hours-of-service regulations.

The Motive Vehicle Gateway is an ELD, a hardware device that connects to the diagnostic port (ECM) of a vehicle. When used with the Motive Driver App, the Motive Vehicle Gateway automates the recording of driving time in compliance with the USDOT / FMCSA ELD rule found in 49 CFR Part 395 and drivers can manage their hours of service in the Driver App.

What vehicles are compatible with the Motive Vehicle Gateway?

The Motive Vehicle Gateway plugs into all standard 9-pin, 6-pin, and OBDII diagnostic ports. Additionally, if you are using a model year 2013 or newer Mack or Volvo truck, Motive provides a special cable harness. We also provide Y-cables so you can hide the cabling behind a trim panel.

How does the Motive Vehicle Gateway record driving time?

When the Motive Vehicle Gateway detects that the vehicle is moving faster than 5 MPH in the U.S., or 8 KPH in Canada, the vehicle is considered in motion. When the vehicle returns to 0 MPH in the U.S., or 0 KPH for three seconds in Canada, the vehicle is considered stationary. Driving time is automatically recorded in the driver’s electronic logbook if their mobile device is connected to the Vehicle Gateway and they’ve selected the vehicle in the Motive Driver App. The 5 MPH or 8 KPH speed threshold is not configurable as per the ELD mandate.

Can I use the Vehicle Gateway and Driver App without cellular data?

Yes. The Motive Vehicle Gateway and Driver App can be used offline. However, the driver must regularly open the Driver App while connected to a WiFi hotspot to share logs with their company and back up data to Motive’s servers. We recommend using our products with a cellular data plan. Drivers that use the Motive Vehicle Gateway to meet their obligations under the U.S. ELD compliance rule must always ensure that they have an active internet connection.

Does Motive support Personal Conveyance and Yard Move?

Yes. A driver can select Personal Conveyance or Yard Move as special driving categories in the Motive Driver App, when enabled by the fleet manager. Any driving time recorded by the Vehicle Gateway while the driver has selected Personal Conveyance will be considered as off duty time and any driving time recorded while the driver has selected yard move will be considered as on duty time. Fleet admins and managers with adequate permissions can enable or disable a driver for the Personal Conveyance and Yard Move special driving categories in the Motive Fleet Management Dashboard.

Drivers in Canada will automatically be switched to Driving status once they exceed the 75 km Personal Conveyance limit and 32 KPH Yard Move limit to align with ELD compliance rules.

What cycle rules does Motive support?

Motive supports the following HOS cycle rules in the U.S. and Canada:

USA 70 hours / 8 days

USA 60 hours / 7 days

USA Short Haul

California 80 hours / 8 days

Texas 70 hours / 7 days

Alaska 70 hours / 7 days

Alaska 80 hours / 8 days

Canada South 70 hours / 7 days

Canada South 120 hours / 14 days

Canada North 80 hours / 7 days

Canada North 120 hours / 14 days

Canada South Oil and Gas

Alberta Provincial

Where applicable, Motive supports separate rules for property and passenger-carrying vehicles. Additionally, Motive supports ELD-compliance rules for carriers utilizing the oilfield operations exceptions under 49 CFR 395.1(d).

Does Motive support team driving?

Yes, teams with multiple drivers (up to nine co-drivers) can manage their HOS and view inspections and documents from one shared device, seamlessly switching between driver profiles without having to log in/out.

What types of mobile devices are compatible with Motive?

The Motive Driver App is compatible with the majority of Android and iPhone/iPad devices. For Android devices, the operating system must be 10.0 or above. For iPhone/iPad devices, the operating system must be 12.0 and above. Devices without a cellular connection can be used, however the driver should regularly connect their mobile device to the internet via WiFi to automatically sync their data to the Motive servers.

What happens when a driver is in an area with no cellular data service?

The Motive Vehicle Gateway and Driver App can be used offline. The Motive Vehicle Gateway will continue to collect GPS and vehicle data from the vehicle’s diagnostic port (ECM) and send that data to the Driver App. When the mobile device re-establishes an internet connection, that data will automatically be synced and backed up to Motive’s servers.

What happens if the driver forgets to connect to their Vehicle Gateway before driving?

If the driver forgets to log into their Driver App and connect to the Vehicle Gateway before driving, or if the connection gets interrupted, the Vehicle Gateway will continue to record all driving time under the unidentified driver profile as per ELD compliance regulations. When the driver reconnects to the Vehicle Gateway, they will be prompted with an option to accept or reject trips generated under the unidentified driver profile.

Our Smart Trip Match tool uses advanced AI technology to automatically match unidentified trips with recommended drivers and notify drivers in real time. If there’s a dash cam installed, drivers are also instantly alerted if they’re not logged into their Driver App when driving, helping to reduce unidentified trips.

What data transfer types does the Motive ELD support for roadside inspections?

Motive supports the two telematics data transfer protocols specified by the FMCSA for roadside inspections: web services and email. Motive also supports the Canadian email transfer protocols.

What is the difference between the Motive Driver App and the Motive Vehicle Gateway?

The Motive Driver App, when used alone, is a fully editable electronic log. It replaces paper logs. The standalone Motive Driver App is compliant with USDOT/FMCSA rule 395.8(a)(iii). The rule regards a driver’s manually maintained record of duty status and Canada’s commercial vehicle drivers Hours of Service regulations.

The Motive Vehicle Gateway is a hardware device that connects to the diagnostic port (ECM) of a vehicle. When used with the Motive Driver App, the Motive Vehicle Gateway automatically records driving time. It does so in compliance with USDOT/FMCSA’s ELD Rule found in 49 CFR Part 395. Drivers can manage their Hours of Service in the Driver App.

How do the Motive and KeepTruckin ELD solutions differ?

The Motive and KeepTruckin ELD solutions are the same. They’re both powered by our Vehicle Gateway. All Motive products will continue to work the same way under our new branding. Only the name and colors will differ to reflect the Motive brand.

Contact us