Welcome to the September edition of the Motive Monthly Economic Report, where we analyze the major trends in the supply chain and economy across the Motive platform during the past month. Keep reading for a front-seat view into key factors currently influencing the U.S. economy.

Big Picture: Key metrics in retail visits, number of carriers, and carrier starts all improved in August, reversing consistent declines seen throughout 2023. However, potential headwinds are on the horizon, particularly for smaller fleets.

- While August retail visits didn’t match the highs driven by the 4th of July holiday the previous month, they still bested June and rose year over year.

- August brought the lowest net carrier exits since Q1, with 24% fewer leaving the market compared to July.

- Registration of new carriers also rose in August, an unexpected jump potentially driven by the relative consistency in freight rates over the last six months.

- While this data shows positive momentum, the expectation of these trends continuing should be tempered. Drivers saw fewer hours and miles driven in August, and rising diesel prices increasing credit costs are likely to have a disproportionate impact on smaller fleets.

- Motive still expects overall contraction to continue into early 2024; therefore, fleets must continue to prioritize operational efficiency.

Prepare for the worst but hope for the best

Economic indications from Motive’s August data were better than expected and may even be a cause for cautious optimism. However, carriers – especially smaller fleets – should still be planning for potential challenges ahead. Diesel price fluctuations and higher borrowing costs disproportionately impact small fleets. Doubling down on operational efficiency and preserving cash will help fleets of all sizes protect their bottom line. The focus for freight businesses right now and going forward must be efficiency.

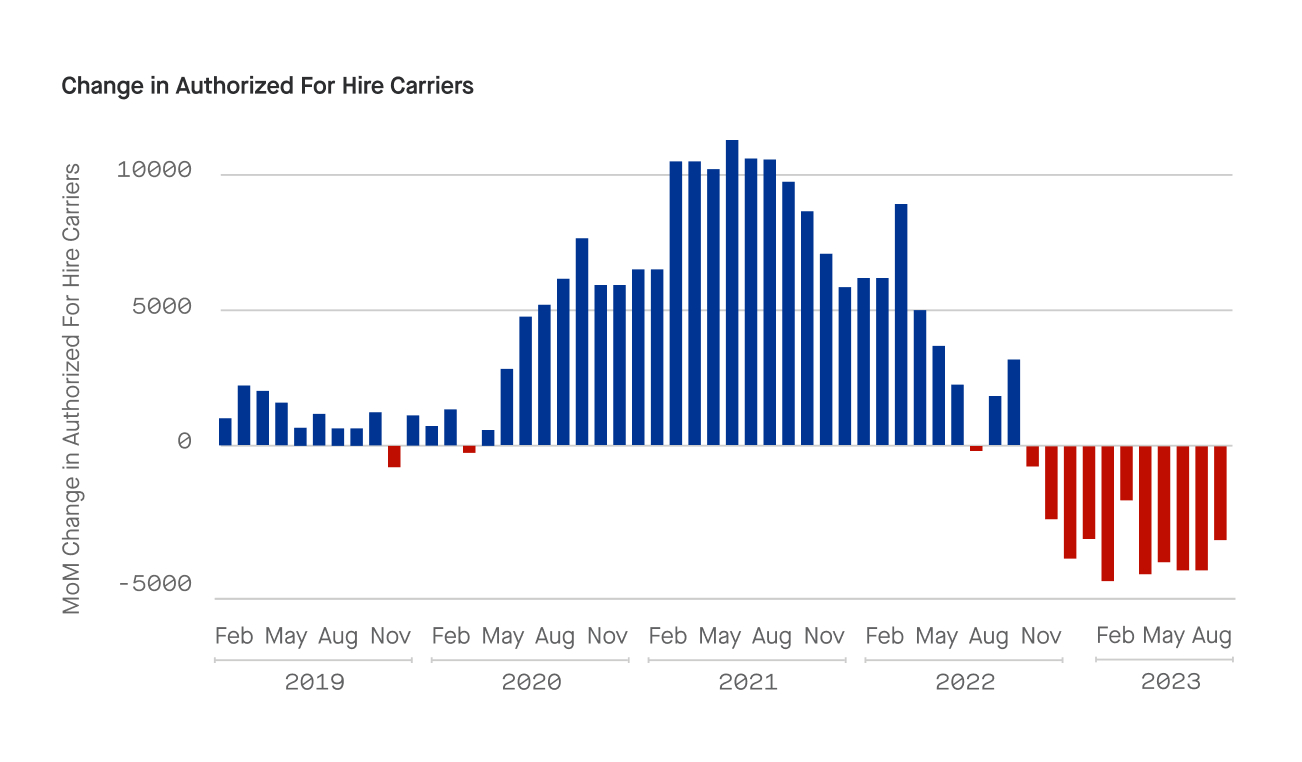

Carrier declines soften

While August still saw declines in the net number of authorized carriers, the contraction was the smallest seen since March of this year. 24% fewer carriers exited the freight market compared to July, marking one of the first positive signs in months for our capacity indicator. It is worth noting that one driver of this may be stabilization after many smaller carriers have been driven out of the market.

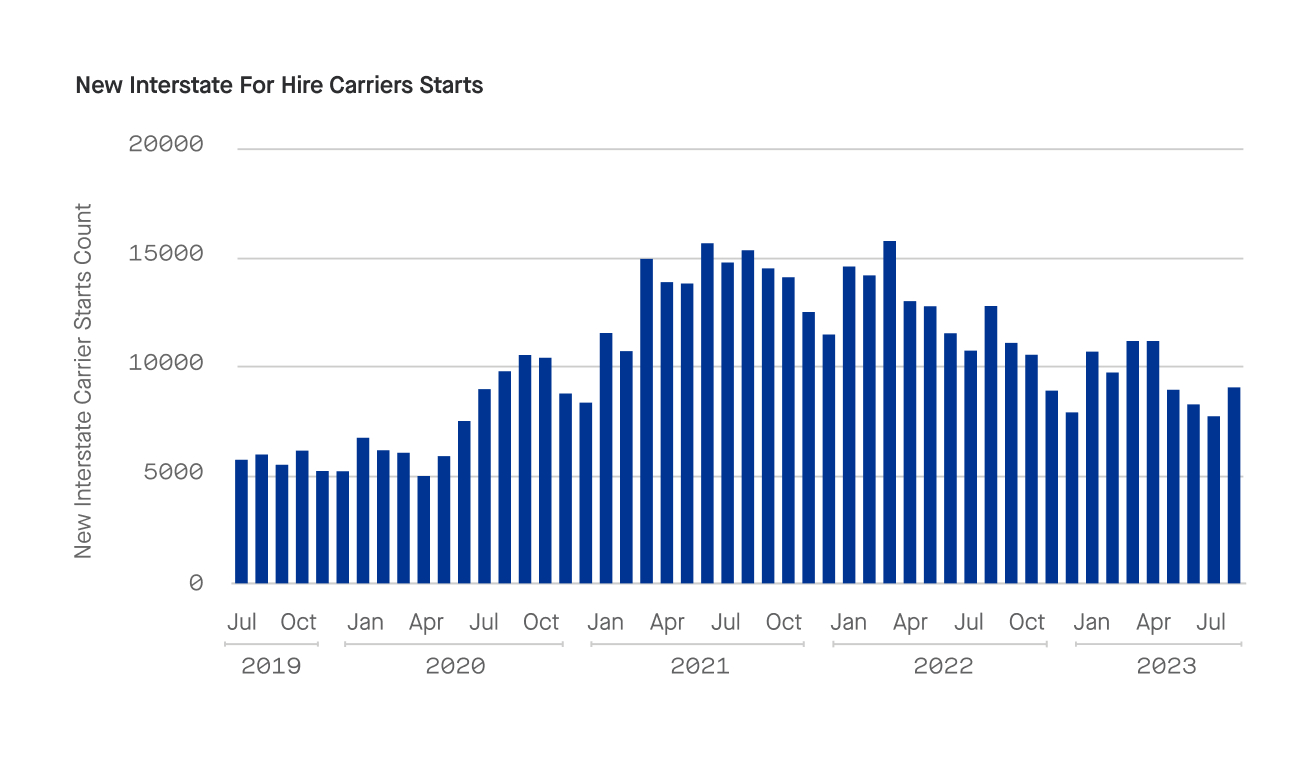

An unexpected jump in new carrier starts

Registrations for new carriers also saw a surprising jump in August, with 17% more carriers entering the market compared to July. Relative stability of freight rates in the last six months may be a factor here, creating a stable enough environment to encourage new business formations. However, the impacts of rising oil and diesel prices on these new carriers has yet to be seen, so a single month can’t yet be considered the start of a trend.

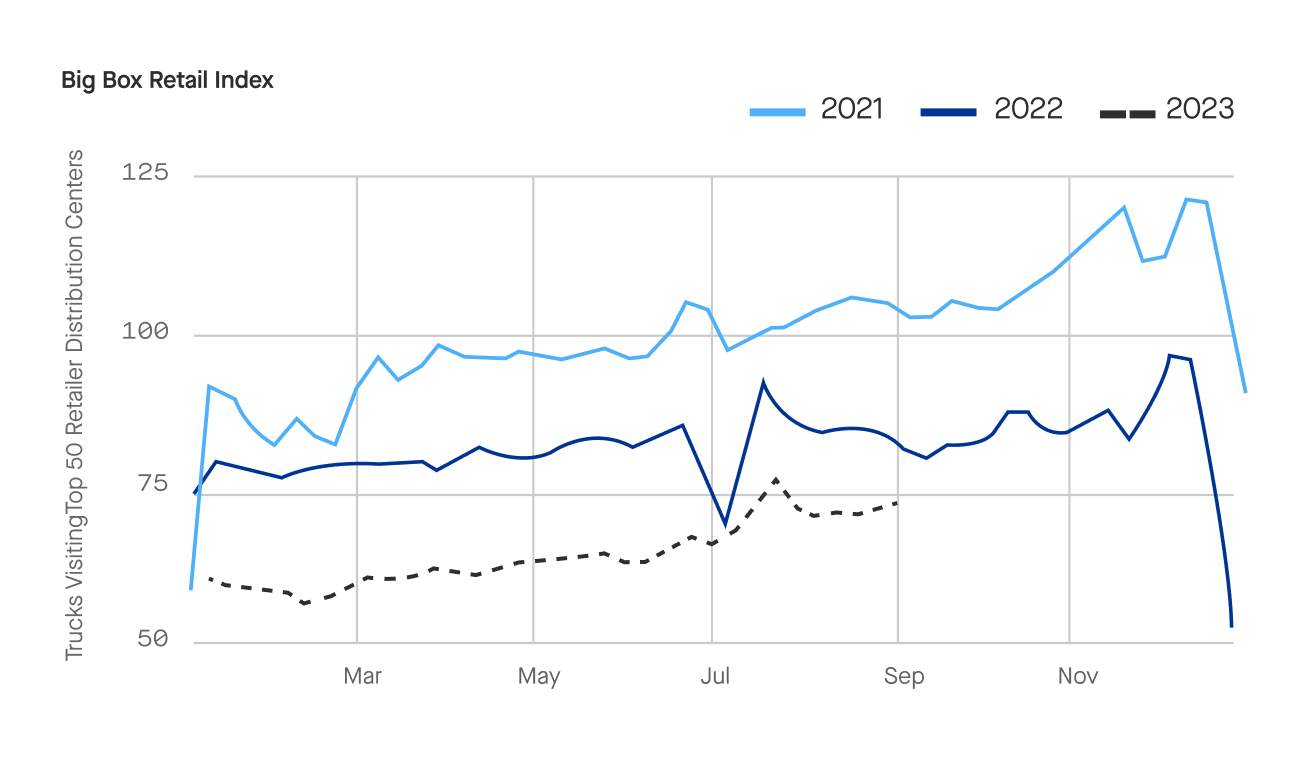

August retail visits up compared to June as results of retailer inventory management efforts start to show

August continued the upward overall trend of Motive’s Big Box Retail Index, which observes trucking visits to warehouses for the top 50 retailers in the US. While still down from the July 4th holiday spike, the index was up 8.1% compared to June, and the relative decrease in August year over year improved. However, this return of retail visits following a lackluster start to 2023 is due less to rising consumer demand and is more a reflection of retailers consistently bringing down their inventories, allowing for more normalized restocking patterns.

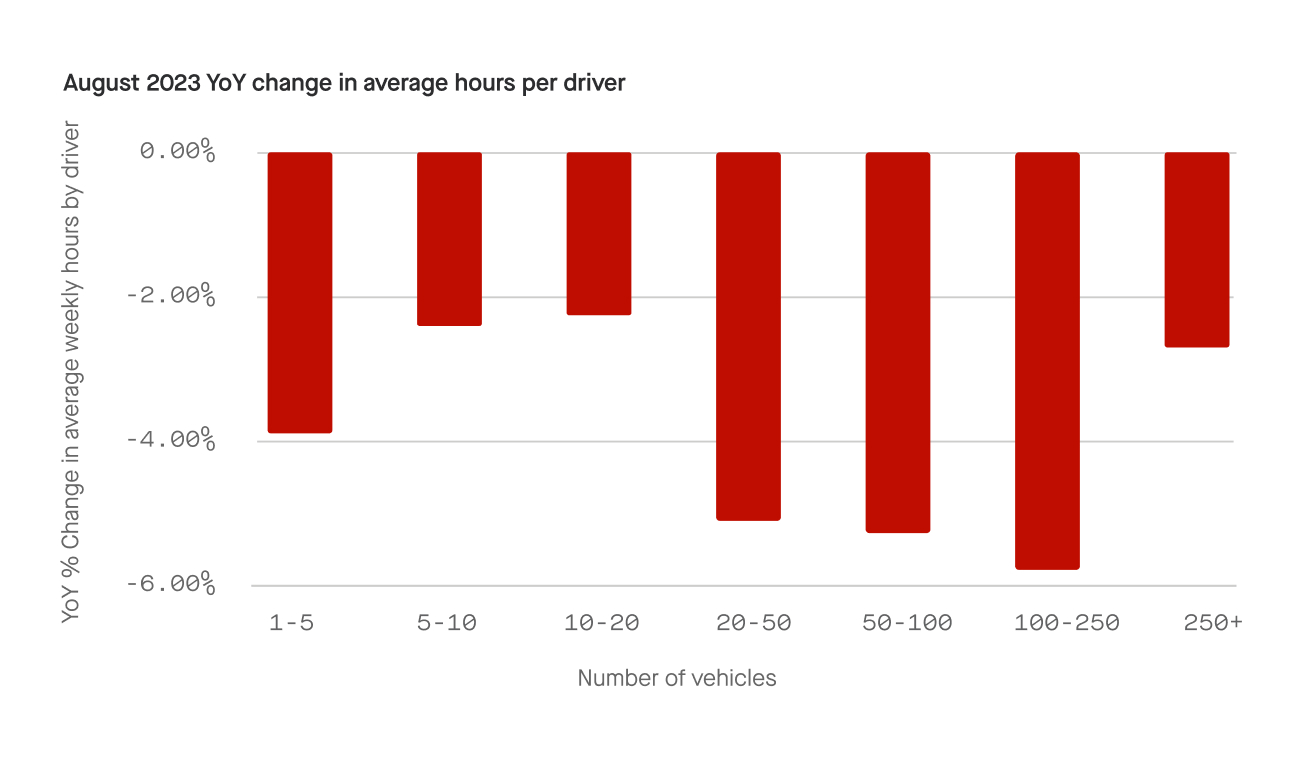

Motive still expects contraction of the market to continue into early 2024

While August saw improving retail and carrier data, not every indicator showed improvement. Along with reports of a sharp decline in trucking jobs in August, Motive’s data showed decreased driver utilization (measured by mileage driven per week) across carriers of all sizes, as well as a drop in the hours driven per week. The latter metric was especially true for the smallest carriers with 1-5 vehicles and midsized fleets ranging from 20-250 vehicles. In addition, headwinds including rising diesel prices and consistently elevated interest rates are maintaining an environment of high operating costs that will disproportionately impact these smaller fleets. Overall, we expect the contraction of the market to continue into early 2024, with volumes following similar trends to 2019 and carrier numbers still being severely inflated due to the 2021 bump.

Data Methodology

The Motive Monthly Economic Report uses aggregated and anonymized insights from the Motive network, as well as publicly available government data from the Federal Motor Carrier Safety Administration, U.S. Census, and U.S. Department of Transportation.