Products | IFTA Compliance

The best way to think about IFTA reporting? Don’t.

Automate IFTA reporting

Automate complex calculations

Improve operational efficiency

Automations to scale the back office

Reduce audit risk and human error

Fuel Tax Management

Automate IFTA fuel tax reporting and eliminate the administrative burden of collecting state mileage and fuel receipts.

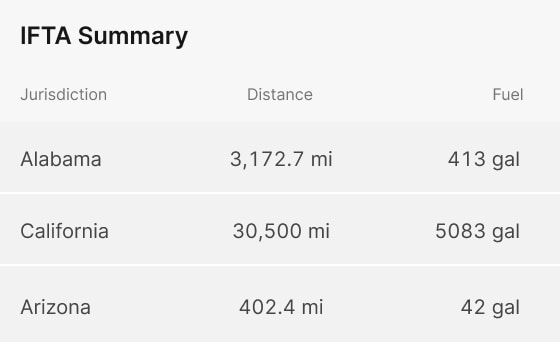

Easily file

Motive’s IFTA software for fuel tax reporting automatically calculates the distance traveled and fuel purchased by jurisdiction. View trip reports in detail, or filter summaries by date or vehicle type.

Import fuel receipts

Add fuel purchases individually or in bulk by uploading a CSV file from your fuel vendor. Drivers can also upload fuel receipts on-the-go from the Motive App.

Customers love us

Get Started Today

Enhanced Fuel Tax Management

Frequently Asked Questions

How does the Motive Vehicle Gateway help with IFTA filings?

The Motive Vehicle Gateway uses its GPS sensor and the vehicle’s odometer to track the exact distance a vehicle travels in each IFTA jurisdiction every day. Fleet managers can generate reports in the Motive Dashboard to calculate the total distance each vehicle traveled in each state/province for any date range.

What about special mileage exemptions, such as toll roads?

The Motive Vehicle Gateway records a vehicle’s location each minute while the vehicle is in motion. A vehicle’s location history combined with the distance by jurisdiction report available in the Motive Dashboard can be used to identify and claim mileage exemptions.

Does Motive automate the filing of my IFTA paperwork?

Not yet. Currently, Motive helps fleet managers with the most difficult part of the process — tracking the distance your vehicles travel in each jurisdiction. In the future, you will be able to import fuel purchase data as well, helping you further automate the process.