The International Fuel Tax Agreement provides uniform administration of motor vehicle fuel tax collection across the continental United States and the bordering Canadian provinces. Fleets use IFTA reporting to ensure they pay sufficient taxes on their consumption of fuel in each jurisdiction.

IFTA reporting rules and regulations

If you’re based in one of the 48 United States or 10 Canadian provinces that are members of IFTA, and you operate across two or more of the member jurisdictions, you’ll need to license your qualified motor vehicles.

IFTA requires reporting for every motor vehicle used to transport people or property. Qualified vehicles include:

- Gross vehicle or registered gross vehicles with a weight over 26,000 lbs. or 11,797 kgs.

- Three-axle vehicles regardless of weight

- Vehicles used in combination when the weight of the combination exceeds 26,000 lbs. or 11,797 kgs

Fleet owners and operators can license each qualified motor vehicle to operate throughout all jurisdictions. The license comes with a set of IFTA decals which should be affixed to the exterior driver’s side and passenger’s side of the cab.

Licensees only have to file one tax return each quarter to their base jurisdiction. They’ll see either one tax payment or refund, to or from that base jurisdiction. And, if there’s a need for an audit, it would only be in the home jurisdiction. All of this simplifies the tax reporting and helps reduce administrative costs.

Meanwhile, the jurisdictions benefit from IFTA reporting as well. They deal with fewer taxpayers, increased enforcement and audit coverage, and lower administrative burden and costs.

IFTA reporting Q&A

IFTA reporting covers fuel taxes and requires accurate documentation of fuel purchases. Appropriate IFTA reporting can help fleets avoid compliance issues and penalties or fines. Once a qualified vehicle is registered in its base jurisdiction, drivers can travel in all member states and provinces. Drivers and their managers could have many questions about IFTA reporting. Here we answer several frequently asked questions.

What is IFTA reporting?

IFTA consolidates fuel taxation for 10 Canadian provinces and all states except for Alaska and Hawaii. In the past, drivers had to obtain fuel permits from every state or province they entered. Now, IFTA establishes uniformity and efficiency.

You’ll collect the following for each motor vehicle for IFTA reporting:

- Miles driven in each jurisdiction

- The odometer reading at each state line crossing

- Total gallons of fuel purchased in each jurisdiction

- The original fuel receipts or invoices

- Individual trip reports

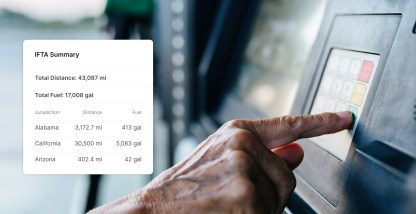

Carriers must file quarterly reports aggregating the miles driven and fuel purchased for the quarter by jurisdiction. Using the consolidated information, carriers can calculate overall fuel mileage:

Total miles driven ÷ Total gallons = Overall fuel mileage

Carriers will also report how many gallons of fuel their vehicles consumed in each individual jurisdiction using the formula:

Total miles driven in state X ÷ Overall fuel mileage = Fuel consumed in jurisdiction X

The result is then multiplied by the current tax rate for the jurisdiction. The tax matrix can change quarterly, so keep an eye on the updates for the correct filing.

What does IFTA stand for?

IFTA stands for the International Fuel Tax Agreement. Don’t confuse this with IFTA, Inc., which is the International Fuel Tax Association, Inc. The Arizona-based not-for-profit manages and administers the International Fuel Tax Agreement.

How do I file an IFTA report?

You file an IFTA report in the base jurisdiction where you obtained your IFTA license using an IFTA reporting form.

You’ll file quarterly:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: Oct. 31

- Fourth quarter: Jan. 31

Even if the qualified vehicles didn’t drive outside the state or purchase taxable fuel in that quarter, you’ll still need to file.

You can file IFTA in five steps:

- Track mileage in each state

- Add fuel purchases

- Calculate fuel consumed per state

- Calculate taxes owed for each state and province

- Use this formula [Fuel tax required in state X – Fuel tax paid in state X = Fuel tax owed to state X] to calculate the actual tax amount owed to each state or province

How do I file IFTA online?

Many states and provinces have an online filing and payment platform for IFTA quarterly returns. You will typically need to set up an online account in your base jurisdiction, then you can file electronically through that site.

What happens if I don’t file IFTA?

Failure to file an IFTA return nets a penalty of $50 or 10% of the total tax due, whichever is higher. Your license may also be suspended if you do not file within 30 days after the quarterly deadline.

How do I apply for an IFTA license?

First, you’ll fill out an application form in your home state. Expect to provide basic carrier information such as a registered business name, a mailing address, a federal business number, and a USDOT number.

If downloaded online, completed IFTA forms can be sent by mail. Other jurisdictions also allow IFTA forms to be sent by fax or through taxpayer service offices.

How often do I renew my license?

IFTA licenses must be renewed annually. Each year’s decal expires at year’s end, so plan your renewals accordingly.

Can I drive without an IFTA sticker?

Federal law requires that commercial companies abide by IFTA regulations. Registration is non-negotiable if your vehicle meets the qualified motor vehicle criteria. You should not have cause to drive without a sticker, as once your application is processed you will be sent temporary documentation to serve until the decals arrive.

Driving without an IFTA sticker can cost up to $500 or more per violation.

What fuel is reported in IFTA?

Fuel records must be maintained for all motor fuel purchased, received, and used in the conduct of business. Account for each fuel type, whether purchased retail or bulk, separately.

What’s the difference between taxable gallons and tax-paid gallons?

Taxable gallons refers to the number of gallons used in each IFTA jurisdiction for that quarter. Tax-paid gallons means fuel pumped into qualified motor vehicles upon which tax has been paid.

How do I calculate IFTA for fuel tax reporting?

To calculate IFTA tax for fuel tax reporting you’ll need to calculate:

- Total miles driven in each state/province X ÷ Overall fuel mileage = Fuel consumed in each state/province X.

- Fuel tax required in each state/province X – Fuel tax paid in each state/province X = Fuel tax still owed to each state/province.

How do I keep track of my IFTA miles?

You could track IFTA miles in a notebook by writing down odometer readings. Yet, IFTA reporting is simplified when you use GPS tracking and routing software to record mileage and track miles in each state.

With the Motive ELD Pro, carriers can accurately calculate IFTA fuel tax reports in just a few clicks. And, you can automatically include Motive Fleet Card fuel purchases in IFTA reports.

How can I simplify IFTA reporting?

Your fleet management solution can help streamline IFTA reporting and prepare you for a potential audit by:

- Automatically tracking miles driven and fuel purchased for each vehicle.

- Saving individual trip reports, including state line odometer readings.

- Allowing drivers to easily upload fuel receipts and append the odometer reading to automatically associate them with trips.

- Accounting for fuel purchases and automatically associating them with trips in bulk at the end of the quarter if you integrate fleet fuel cards with the fleet management software.

How does Motive help with IFTA reporting?

IFTA aims to make your life easier and simplify fuel tax collection. Still, it means work for fleet operators. Motive’s fleet management platform simplifies data collection and fuel tax reporting. Our cutting-edge technology does away with manual number crunching and automates processes involved to reduce the risk of errors.

With Motive’s solution, you can cut the time and money spent on IFTA reporting and reduce the risks of audits.

Simplify IFTA reporting with Motive

Motive’s solution simplifies state mileage collections and consolidation of your fuel receipts. Our IFTA tools automate complex calculations. Plus, you can easily export ready-to-file reports right from your Fleet Dashboard.

The Motive fleet card further streamlines IFTA reporting by integrating spend management across the fleet. You can save on fuel and maintenance while also enjoying transparency into your purchase history. Details like vehicle, fuel type, and more are automatically assigned to each purchase.

Get started with easier, more accurate IFTA reporting today. Contact our team for a demo.